After extreme market volatility and record-high prices in recent years, global fertiliser prices are expected to settle in 2024, despite uncertainty posed by the Israel-Hamas conflict as it currently stands, Rabobank says in a new report.

In its just-released Semi Annual Fertiliser Outlook, titled What is next?, the agribusiness banking specialist says while the Israel-Hamas conflict creates some uncertainty in the outlook for fertiliser markets, the current impact for the food and agri sectors is manageable.

Report co-author, RaboResearch farm inputs analyst Vitor Pistoia said overall, farmers around the world may feel some negative impact due to potentially rising costs of energy and fertilisers, at the margin, as well as slightly lower import demand and prices for grains and oilseeds due to the Israel-Hamas conflict.

“However, if the conflicts spreads to the broader Middle East/North African (MENA) region, impacts on fertiliser supply – as well as grain, meat, and dairy demand – could be notable, he said.

The report notes Israel is an important exporter of potash and phosphorus – in 2022 exporting six per cent of the world's potash and eight per cent of its phosphate fertilisers.

It remains to be seen how much of those trade volumes will be impacted in the coming months, Rabobank says.

While the broader MENA region, the bank says, accounts for about 30 per cent of the world’s nitrogen fertiliser exports (top five exporters: Qatar, Saudi, Egypt, Oman, Algeria), more than 25 per cent of global mixed fertiliser exports (top three: Morocco, Saudi, Israel), approximately 10 per cent of potassic fertilizers (top three: Israel, Jordan, Egypt) and almost half of the phosphatic fertiliser exports (top five: Morocco, Israel, Egypt, Lebanon, Tunisia).

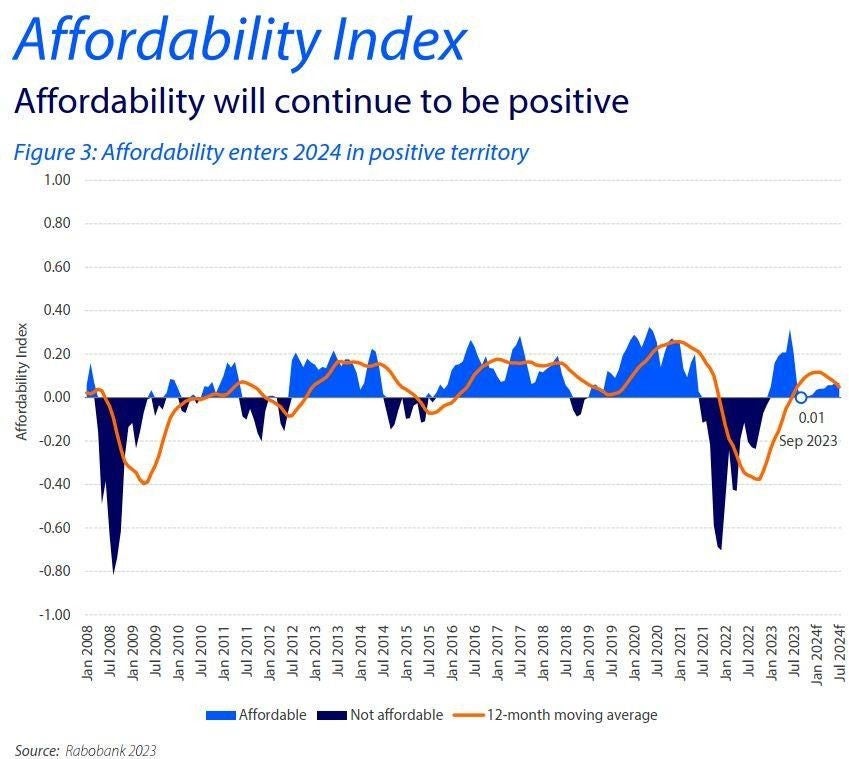

Affordability index

Mr Pistoia said: “while we are still some months away from 2024 – this year has been a much calmer year for the fertiliser market – and 2023 can be seen as a transition year, even with some remnants of all the market complications from 2022”.

The bank’s models indicate a recovery in global fertiliser usage in 2023, up by around three per cent, compared to the seven per cent drop in 2022.

For 2024, Mr Pistoia said, the initial analysis suggests an increase in global fertiliser use close to five per cent. “All this aligns with our affordability index (which tracks the cost of fertiliser relative to the prices achieved for grain and oilseeds.), which shows a much higher value than a year ago.”

The index’s movement reflect the bank’s expectation for usage growth for 2023, Mr Pistoia said, with nitrogen usage growing two per cent, phosphate 3.90 per cent and potash five per cent.

For Australia

Mr Pistoia said it was “clear that the period of plentiful rainfall across Australia was now over”, with the prevailing El Nino climate outlook signalling lower rainfall expectations.

"Across the country, there is a wide variety of crop and pasture conditions. And while there is still room for improvement, or even deterioration of conditions in the paddocks, some elements are already consolidated and will set the tone for fertiliser demand for the coming season,” he said.

The bigger picture is positive for Australian farmers buying fertiliser, Mr Pistoia said, with prices coming down “massively” since mid-2022. “And the past seasons have been good in terms of performance so there has been reasonable cash flow throughout agricultural supply chains,” he said.

However, Mr Pistoia said, there “are still major question marks to address before filling up the sheds (with fertiliser) again”.

“Firstly, how will this season end? Undoubtedly, some regions of the eastern states will reduce application rates due to the current dry seasonal conditions, as well as pockets in Western Australia are also experiencing dryness,” he said. “Increased fertiliser demand might come from South Australia, Victoria and southern New South Wales, which have fair to good crop conditions.”

The other major question, Mr Pistoia noted, was how much the recent drop in the Australian dollar would offset the reduced cost of fertiliser in farmers’ budgets.

“And when this is combined with the recent crude oil hikes, how much is left in those budgets to increase fertiliser application rates?,” he said.

On the upside, the Rabobank analyst said, “besides lower global fertiliser prices, we have many commodities that have firm to good price levels – especially from an Australian perspective”.

“Leading the way are sugar cane markets at record highs, while lentil prices are tracking well due to damaging rainfall in India and there is a good floor for the wheat, barley and canola markets. The basis – which is the price difference of local markets versus the global reference – is back in positive territory,” he said.

Mr Pistoia said there was a constant challenge for Australian farmers to find the right soil nutrition point, and this had been stretched in the past three seasons after consecutive bumper grain harvests.

“The 2022 season saw a drop of 30 per cent for phosphate fertiliser application, and 31 per cent fall of potash usage in Australia – due to high fertiliser prices and international logistics challenges,” he said. “The application of these two nutrients should bounce back for the 2023 season and especially for the coming 2024 season. As fertilisers should be more affordable and the soil needs it to balance the nutrient extraction of the recent good yields.”

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 90 branches throughout Australia and New Zealand.

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com