Open Banking allows you to take control of your banking data and share it securely with accredited organisations. It was introduced by the Australian Government under legislation called the Consumer Data Right (CDR).

You can choose to share some of your banking data with accredited organisations so they can provide you with an appropriate product or service. You could share your banking data with other organisations for services such as product comparison, tailored product recommendations, finding the best deal on your banking services, budgeting, consolidation of your accounts, and other services.

A list of all the accredited organisations is available on the Australian Government’s CDR website here.

Types of CDR Data available for sharing

You can choose which data you want to share, and how long you want to share it for (e.g. for 3 months, 6 months, or up to 12 months).

Client Data (upon your consent)

- Name and contact details

- Account information (such as balance, direct debits, scheduled payments)

- Transaction details

Rabobank also makes available to anyone our standardised product data, to facilitate services such as market-wide product comparisons.

Product Data (publicly available)

- Product name and eligibility criteria

- Terms and conditions

- Interest rate

- Fees or discounts

Who can share data?

Data sharing is currently available for Farm Business (Rural Banking) clients and Rabobank Online Savings clients who meet the Open Banking eligibility criteria.

Individuals, sole traders and joint account holders

To be eligible for data sharing, individuals, sole traders and joint account holders must:

- be at least 18 years old

- be the account owner of an eligible individual, sole trader account or joint account; and

- have at least one account with Rabobank that is open and accessible through Internet Banking.

In addition, to be eligible to share account information and transaction details from a joint account:

- all joint account holders need to meet the above criteria; and

- the joint account must be enabled for data sharing (learn more here)

Secondary users associated with individual, sole trader and joint accounts (Farm Business only)

Eligible Farm Business clients who are individuals, sole traders or joint account holders can choose another person (such as an authorised signatory) as a ‘secondary user’ to manage data sharing on their behalf. To be eligible, this ‘secondary user’ must:

- be at least 18 years old

- have Internet Banking access to the account as a full or delegated user; and

- not be the account owner.

Entities such as partnerships, companies and trusts

Entities such as partnerships, companies and trusts can nominate representatives to manage data sharing on their behalf. To be eligible for data sharing, these entities must have at least one eligible account with Rabobank that is open and accessible through Internet Banking. To be eligible to share data on behalf of these entities, the representatives must:

- be at least 18 years old; and

- have Internet Banking access to the account as a full access user.

Farm Business (Rural Banking)

If eligible, you can share your name, contact details, payees, account information (such as balance, direct debits and scheduled payments) and transaction history for these products:

- All In One (AIO) account

- Call Deposits

- Term Deposits

- Cash Management Accounts

- Premium Cash Management Accounts

- Farm Management Deposits (variable and fixed rate)

Rabobank Online Savings

If eligible, you can share your name, contact details, account information (such as scheduled payments), and transaction history for these Rabobank Online Savings accounts:

- High Interest Savings Account

- Purpose Saver

- Notice Saver

- PremiumSaver

- Term Deposits

How to share your data

You’ll need to have a valid mobile phone number linked to your Rabobank account. This is required to authenticate with a one-time password. If you don’t already have this, you’ll need to update your contact details first.

You’ll need to be registered for Internet Banking for the product/s you would like to share data from. If you’re not currently registered, you’ll need to do this before proceeding. To find out how to register for Internet Banking, click here.

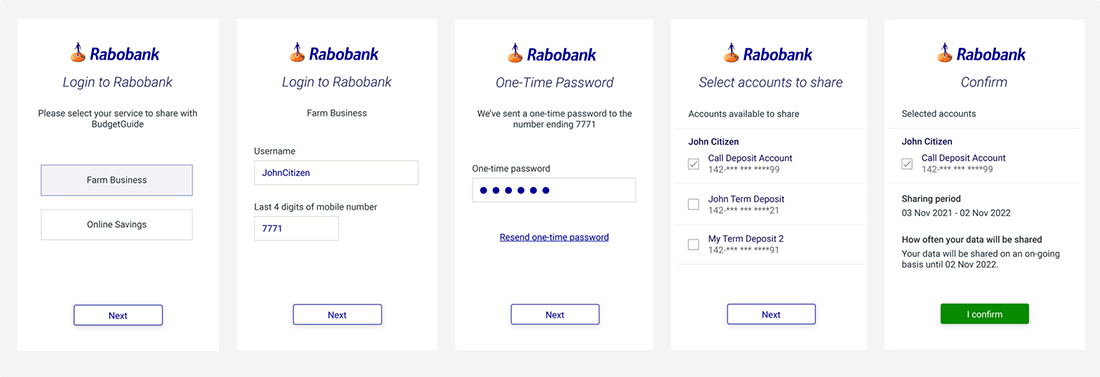

Provide your consent on the website or app of the accredited organisation you want to share your banking data with. You need to select the banking data you would like to share, and the period of time you would like to share it for (e.g. for 3 months, 6 months, or up to 12 months). Select “Rabobank” to continue the data sharing consent process with Rabobank.

You’ll then be redirected to Rabobank so that you can authorise and set up data sharing in just a few steps as outlined below.

- Select Farm Business to share data from your Farm Business account, or select Online Savings to share data from your Rabobank Online Savings account.

If you have both a Farm Business account and an Online Savings account that you want to share data from, you’ll need to provide your consent separately for each. - For Farm Business accounts, enter your username and the last 4 digits of your mobile number.

• Your username is what you use to log in to your Rabobank Internet Banking.

• Your mobile phone number can be any of the numbers linked to your Farm Business account.

For Rabobank Online Savings accounts, enter your Rabobank Online Savings customer number and the last 4 digits of your mobile number.

• Your customer number is the 8 digit customer number that you use to log in to your Rabobank Online Savings Internet Banking.

• Your mobile phone number can be any mobile number linked to your Rabobank Online Savings account. - You will receive a one-time password as an SMS on your mobile phone to verify you. Enter the one-time password within 5 minutes.

- Select the accounts you would like to share data from.

Clients who have multiple entities will be asked first to select which entity to share with the accredited organisation. - Confirm the data and accounts to be shared. You will then be returned to the website or app of the accredited organisation you have elected to share data with.

Enabling a joint account for data sharing

Joint accounts are already enabled for data sharing and you won’t need approval from other account holders to set up data sharing arrangements with accredited organisations (unless you or any other account holder disabled your account for data sharing – learn more here).

You can change your data sharing preferences or stop a data sharing arrangement at any time. If you choose to disable your account for data sharing, then you and all other account holders will need to agree to re-enable it.

To re-enable data sharing:

- In Internet Banking (not available in mobile banking app) go to Services & Settings and select Joint account permissions under the Open Banking menu. Choose the joint account you want to share data from and press the ‘Enable data sharing’ button.

- Your other joint account holder/s will receive a message asking them to agree to or reject your request.

- If they agree, your joint account will be enabled and you can select it from the list of accounts eligible for data sharing.

Setting up a data sharing ‘secondary user’ (Farm Business only)

Farm Business clients who are individuals, sole traders and joint account holders can choose another person (such as an authorised signatory) as a ‘secondary user’ to manage data sharing on their behalf. Your secondary user will be able to set up data sharing arrangements with accredited organisations without further approval, and you’ll be able to stop them from sharing your account information at any time.

To set up a data sharing secondary user:

- In Internet Banking (not available in mobile banking app) go to Services & Settings and select Secondary user instructions under the Open Banking menu.

- Choose the person you want to share data on your behalf. The list includes everyone who is eligible to be a secondary user (for more information on Open Banking eligibility, click here).

- Select the account you want the person to share data from, and press the ‘Enable data sharing’ button.

- Repeat step 3 for any further accounts you want them to share data from.

Nominating a data sharing representative for entities such as partnerships, companies and trusts

- Farm Business: Complete an Account Operating Authority form and check or uncheck ‘Yes’ in the Open Banking box under Section E.

- Rabobank Online Savings: In Internet Banking (not available in mobile banking app) go to Services & Settings and select Nominated Representative under the Open Banking menu. Under Nominated representative check or uncheck “I hereby nominate myself to act as a representative for this entity” then click ‘Save’.

For assistance please contact us.

View or manage sharing

You can view details or stop sharing by:

- In Internet Banking (not available in mobile banking app) go to Services & Settings and select Data sharing arrangements, or

- Phoning us on:

• Rabobank Australia (Farm & Agribusiness)

1800 025 484 (free call), Mon - Fri 6am - 8pm (Sydney time)

If you're overseas call: +61 2 8268 4511

• Rabobank Online Savings

1800 445 445 (free call), Mon - Fri 6am - 8pm (Sydney time)

If you're overseas call: +61 2 8268 4513

For joint account holders, you can also:

- Disable or re-enable a joint account for data sharing in Internet Banking by going to Services & Settings, Open Banking, and selecting Joint account permissions; and

- Change your notification preferences in Internet Banking by going to Services & Settings, Open Banking, and selecting Notifications.

For Farm Business clients who are individuals, sole traders and joint account holders, you can also:

- Set up a secondary user to share data on your behalf, or withdraw this, in Internet Banking by going to Services & Settings, Open Banking, and selecting Secondary user instructions; and

- Change your notification preferences for your secondary user/s’ data sharing activities, in Internet Banking by going to Services & Settings, Open Banking, and selecting Notifications.

Our Consumer Data Right policy

Our CDR policy provides information about how Rabobank manages data under the CDR. It describes how you can access and correct your CDR data, as well as how you can make a complaint about how we handle your CDR data.

Your Privacy and Security

Information for developers

Click here to find Rabobank’s Open Banking APIs (Application Programming Interfaces).

Self-reported implementation gaps we’re rectifying

For a detailed summary of the current implementation gaps, please refer to the table below:

| Product Line | Issue | Expected Resolution Date |

|---|---|---|

| 1. Retail Online Savings | All applicable tiers are not being shared. Currently sharing only the tier associated with the current account balance. | 31 March 2026 |

| 2. Retail Online Savings | All applicable rates should be shared. Currently sharing only the rate applicable to the first balance tier. | 31 March 2026 |

| 3. Retail Online Savings | The overall deposit rate should be shared. If more than one balance tier is applicable, it must be the weighted average interest rate. Currently sharing an incorrect overall deposit interest rate if more than one balance tier is applicable. | 31 March 2026 |

| 4. Retail Online Savings | The correct applicable balance range of 0 to 250,000 should be shared. Currently Sharing an incorrect balance range if the introductory bonus and more than one balance tier is applicable. | 31 March 2026 |

| 5. Farm Business | The deposit rate tiers should not be shared 31 March 2026 because the CB accounts have a single interest rate which applies to the entire balance. Currently sharing only one tier which is associated to the current account balance. | 31 March 2026 |

For further details and the latest updates on Rabobank’s implementation gaps, please check the ACCC CDR rectification schedule (under the section Banking-non-major Data Holders, for Rabobank).