Internet and Mobile Banking will be offline for scheduled maintenance between 10pm 28 February - 6am 1 March and between 7pm - 10pm 1 March.

All In One - Regulated Loan Standard Line of Credit Australian Variable Rate changes available here.

Our Notice Saver accounts offer rewarding rates for planning ahead, helping you stay focused on your savings goals and mature about your spending. Plus will support Aussie farmers through thick and thin!

UP TO

%

P.A*

variable rate up to $250,000

* Rate shown is for Personal 90 Day Notice Saver only, different rates available for 31 and 60 Day as well as SMSF and Business customers. Rates are variable and subject to change. Please read the terms and conditions and Notice Saver PDS before making investment decisions.

Our Notice Saver accounts offer rewarding rates for planning ahead, helping you stay focused on your savings goals and mature about your spending. Plus will support Aussie farmers through thick and thin!

Earn up to

%

P.A*

Personal variable rate on balances up to $250,000

* Rate shown is for Personal 90 Day Notice Saver only, different rates available for 31 and 60 Day as well as SMSF and Business customers. Rates are variable and subject to change. Please read the terms and conditions and Notice Saver PDS before making investment decisions.

Our Notice Saver accounts offer rewarding rates for planning ahead, helping you stay focused on your savings goals and mature about your spending. Plus will support Aussie farmers through thick and thin!

UP TO

%

P.A*

variable rate up to $250,000

* Rate shown is for Personal 90 Day Notice Saver only, different rates available for 31 and 60 Day as well as SMSF and Business customers. Rates are variable and subject to change. Please read the terms and conditions and Notice Saver PDS before making investment decisions.

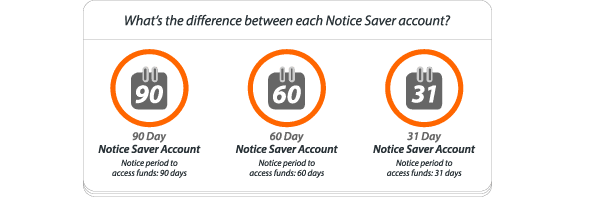

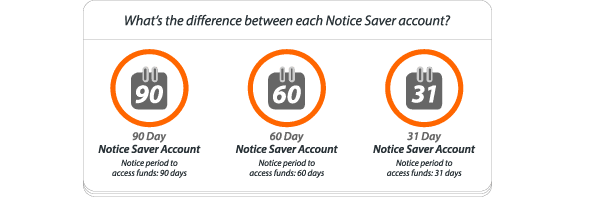

The notice period is the amount of time you have to wait before you can withdraw your planned transfers from your Notice Saver account. You have three Notice Saver accounts to choose from: 31 Day Notice Saver has a 31 day notice period, 60 Day Notice Saver has a 60 day notice period and a 90 Day Notice Saver has a 90 day notice period.

To give notice, you just set up a transfer for the amount you'd like to withdraw in online banking or on our mobile app. Your transfer will automatically happen on the next business day after your notice period has passed. The best part is, you'll still be earning the Notice Saver interest rate right up until your money is withdrawn.

The notice period is the amount of time you have to wait before you can withdraw your planned transfers from your Notice Saver account. You have three Notice Saver accounts to choose from: 31 Day Notice Saver has a 31 day notice period, 60 Day Notice Saver has a 60 day notice period and a 90 Day Notice Saver has a 90 day notice period.

To give notice, you just set up a transfer for the amount you'd like to withdraw in online banking or on our mobile app. Your transfer will automatically happen on the next business day after your notice period has passed. The best part is, you'll still be earning the Notice Saver interest rate right up until your money is withdrawn.

Our Notice Saver Account offers you 31, 60 and 90 day options.

Want to know more? Check out:

The Australian Government Guarantee protects the first $250,000 of all deposits held, per person, with Rabobank.

When you open a new Rabobank Online Savings account, you'll also automatically get a High Interest Savings Account in your savings portfolio, ready when you need it.

Notice Saver is a new type of savings account that we created that requires you to provide and serve Notice prior to withdrawing your money, so it helps avoid temptation that you might get with instant access to your money.

There are 3 Notice Saver Account product options, which each have a different notice period: 31, 60 and 90 days. The amount of notice you choose to give isn't an investment period, it's just the amount of notice you need to give before making a withdrawal. You'll get the benefit of higher variable interest rates, but unlike a Term Deposit you can top up the balance whenever you like so greater flexibility.

There are absolutely no fees on our Notice Saver Account, its feeless!

A Notice Saver is a savings account, a Term Deposit is a fixed deposit with a fixed rate and period. There are several key differences:

Interest is calculated daily and paid into your Notice Saver Account on the first day of every month. You can also redirect the interest so that it is credited to either your High Interest Savings Account, Notice Saver or your Purpose Saver account.

Unfortunately we can't release your funds early. You will need to serve a Notice period and access your funds at maturity. We recommend that you maintain some funds in at-call Savings account (HISA) in case you need funds in a hurry.

For Customers suffering financial hardship you can apply for early release of your funds. Please note that you will need to complete a statutory declaration as proof of your financial hardship. Please contact our Customer Experience Centre for more information.

Yes, interest rates offered on our High Interest Savings Account, Purpose Saver, Notice Saver and PremiumSaver are variable and may change. Our Term Deposits have fixed rates.

We'll always let you know when the interest rates change.

Yes, you can download and register the Rabobank Online Savings app on up to 5 devices.

Unless otherwise specified, Rabobank Australia Limited ABN 50 001 621 129 AFSL 234 700 is the issuer of the products and services described on this page. Any advice provided is of a general nature only and has been prepared without taking into account your objectives, financial situation or needs. Consider the relevant disclosure documents and terms and conditions for these products, including the Product Disclosure Statement for the Notice Saver Account (all available at www.rabobank.com.au, Rabobank branches or by calling 1300 30 30 33) along with your personal objectives, financial situation and needs before making any financial decisions.