Posted by on

11/11/2022

Bethan Wearmouth, Rabobank Senior Fraud Detection and Response Manager

“Tell him he’s dreaming!” It became a well-worn catch-cry after the iconic Aussie film “The Castle”, but just like Dale Kerrigan, it’s best to have your wits about you when purchasing goods sight unseen.

This International Fraud Awareness Week, Rabobank Fraud Detection and Response Senior Manager Bethan Wearmouth is encouraging the community to remember – if it’s too good to be true, it probably is.

For most on the land, scouring trade magazines and clearing sales for used machinery is a well-enjoyed pastime, yet as these sales have moved online, so too has the potential for scammers.

For anyone purchasing goods through an online marketplace, particularly machinery, vehicles, and pets, Bethan said to beware of anything being sold with a sense of urgency.

“If it’s cheaper than elsewhere and needs to be sold fast, alarm bells should be ringing.”

Trust your instincts

Bethan recommended doing thorough research before committing to purchase, and suggested searching for the sellers ranking on marketplace, checking marketplace reviews for negative feedback, check logos against legitimate sites and googling phone numbers and business names to see if they are listed as being used in previous scams.

Another clever tip was to look up the domain name, if it’s a newly registered website Bethan said the chances of it being legit were slim.

“Considering the scale of rural Australia it’s not always possible, but I would advise against purchasing anything sight unseen, and more than anything, trust your gut instinct.”

Horror stories of online purchasers travelling hours to collect machinery, vehicles, even horses - only to find their goods are nowhere to be seen, and the seller uncontactable – are rife across rural Australia.

“Once you’ve paid for your item, and we often see cases of people transferring tens, even hundreds of thousands of dollars for gear, it’s unfortunately gone."

“One of my biggest tips is try and avoid making up-front payments via a bank transfer, or payments through digital currency, like Bitcoin. Always try to use a secure payment service such as PayPal or credit card, if you have to do a bank transfer, arrange to only transfer half the funds, with the rest transferred upon collection.”

International Fraud Awareness Week is an opportunity for organisations to come together and pledge to spread fraud awareness in their companies and communities.

As Rabobank’s dedicated Fraud Detection and Response Senior Manager, Bethan’s role is to raise awareness of fraud and scams, the impact it can have on clients, the bank, and what can be done to help reduce the risk.

“My team and I help control fraud by ensuring processes are in place while educating staff and clients on how to spot red flags – it’s my passion to prevent fraud.”

A life dedicated to awareness

Bethan is the risk champion who almost wasn’t.

It was during a placement with PriceWaterhouseCoopers as an auditor during her final year of University that a day spent in the forensics team piqued her interest.

Now, 23 years later, she is still passionate about preventing and detecting fraud and protecting communities from scammers.

“It was fascinating, and I knew from that day on it was the career for me.”

Successful in gaining a role in the PriceWaterhouseCoopers forensic services team, Bethan was charged with fraud investigations, fraud risk management and raising fraud awareness – often spending hours in a New York basement following leads and chains of information.

Later, some of the evidence from these investigations would be used to convict fraudsters in court, which she admits was extremely rewarding.

If it’s fishy, forget it

The ACCC’s latest Targeting Scams report reveals that Australians reported losing over $2 billion to scams in 2021, and reports to the ACCC’s Scamwatch show Australian farm businesses lost more than $1.2 million to scammers between 1 January and 31 August 2022, an increase of more than 20 percent compared to the same period last year.

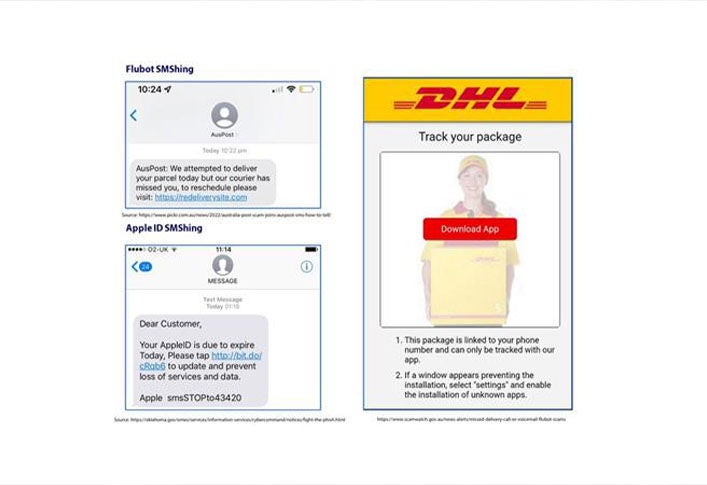

Bethan said phishing, where someone receives an email, social media post, phone call or text messages and is persuaded to click on a link and tricked into sharing personal information such as bank account numbers, passwords and/or installing malware on their devices, is still a prominent scam.

“Think carefully before clicking on a link, even it appears to come from someone you know as emails and numbers can be spoofed,” she said.

Investment scams have caused the highest loss to Australians as a whole as people look for lucrative returns due to low interest rates.

Bethan recommends you to do your own due diligence and research before investing, such as checking official websites and not taking unsolicited emails or prospectuses at face value – always check if they have an AFS licence and a prospectus registered with ASIC.

Business email compromise is another scam to be aware of, and occurs when scammers compromise emails and amend payment details to divert funds.

“There have been cases where people have lost all the money meant for a property purchase as their conveyancers email was hacked and an amended email with the scammer's account details sent.”

“The payment was made to this account and the victim only found out when the conveyancer called to ask where the funds were - by this time the money was gone.”

Bethan said the key message was always to call and verify the account details when paying a new payee or asked to amend payee details, and make sure you are calling on a number from the official website or previous contact - not the number on the email or the invoice.

“Check any other invoices you receive asking you to set up a new payee or make a change to an existing payee and get an IT security professional to check your computer as you won't know if it's your email or the email of the person you were meant to pay who has been hacked.”

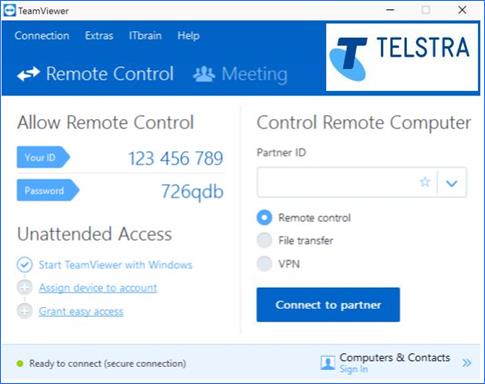

Remote access scams are another sophisticated scam, and occur when someone calls pretending to be from a service provider such as NBN or Telstra and tells you they need to fix a problem or protect your account – and you need to download remote access software to do this.

“If you receive a call like this, hang up, don't listen to them as once you start talking the social engineering they use is so good you start to think they are real - if you are concerned call back using the number from the official website.”

Bethan’s top tips to protect yourself

- Ensure your computer has the most up to date operating systems, use up-to-date browsers and keep your anti-virus software up to date too.

- Put as little information on internet and social media as you can - scammers can use this information to target you, reach out to your contacts and use their links to you to legitimise themselves.

- Use Two-Factor Authentication for all services. Often this is not automatically activated so needs to be done manually. This means access is not just via your username and password but a second code to confirm you own the account is required.

- Sign up to alerts from websites like Scamwatch.gov.au on current scams impacting the community.

- Never share the Digipass or RSA SecurID® token code, user names or passwords - Rabobank staff will never ask you for these to transfer funds out of your account.

- Do not send money or transfer money in response to an unsolicited call, SMS or email.

- Think carefully before clicking on a link in an email or SMS even if the link appears to come from a contact or pops up in a thread from a legitimate organisation or appears to be to a legitimate website. It may still be a scam as websites and phone numbers can be spoofed to appear legitimate. Only access Internet Banking through your bank’s official website and never through a link or Google search.

The information and opinions expressed in this article are general in nature and do not take into account your personal objectives, financial situation or needs. We recommend that you seek independent financial advice from your accountant or financial adviser before making any financial decisions. The statements made and opinions expressed within this video are reasonably held based on the information available at the time of publication. Rabobank does not make any representation or warranty as to the accuracy or completeness of the information. This video may not be reproduced or distributed in whole or in part, except with the prior written consent of © Rabobank Australia Limited ABN 50 001 621 129 AFSL no. 234700.