Results at a glance:

- Australian farm confidence remains at historically-high levels as farmers seek to capitalise on good returns and great seasonal conditions to build their businesses

- National farm viability index hits a new 20-year high

- Confidence strongest among grain growers as they enter favourable planting season

- Australian farmers so far showing resilience to impacts of COVID-19 as China trade tensions and workforce shortages remain a concern

Australian farmers are forecasting another productive and profitable year ahead, with rural sentiment still at historically-high levels thanks to “perfect” summer conditions in much of the nation’s east and exceptionally strong commodity prices.

The latest quarterly Rabobank Rural Confidence Survey, released today, reveals ongoing optimism among Australian farmers who have not only rebounded from significant drought conditions a year ago, but also stared down immense uncertainty and, in some sectors, market volatility as a result of the COVID-19 pandemic.

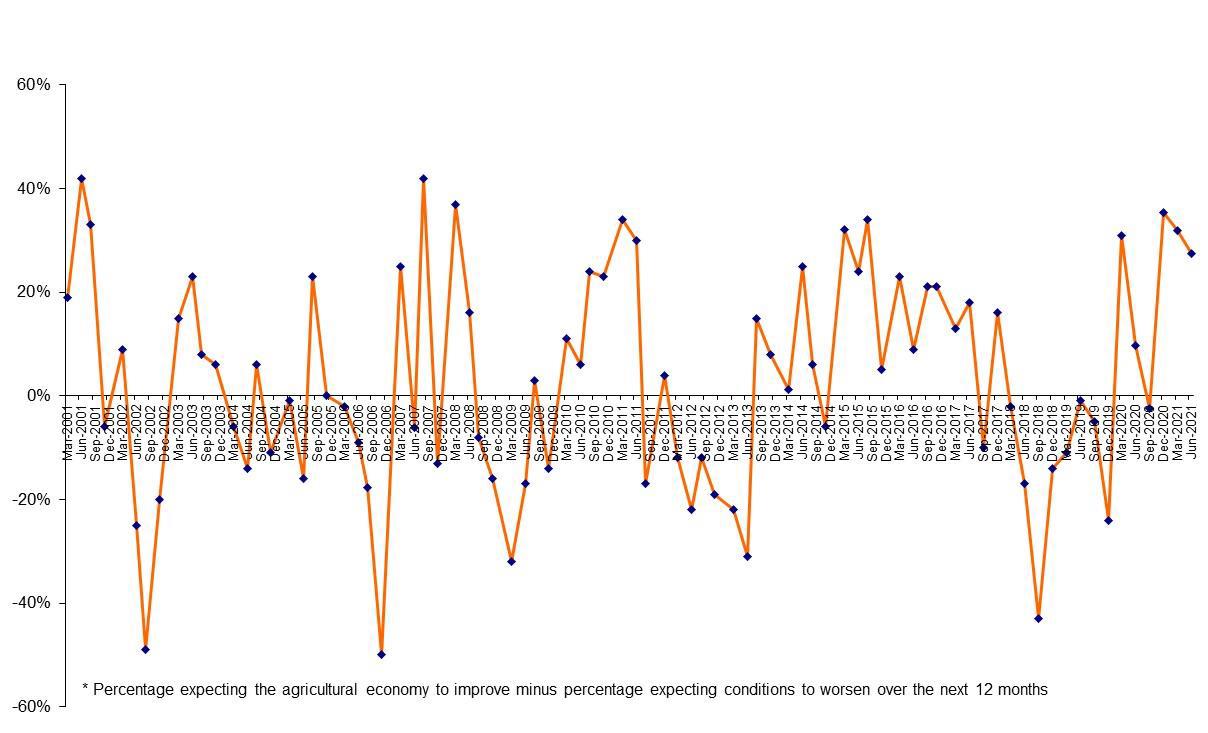

The survey found while overall net confidence had eased slightly from December’s stellar reading, Australian farmer sentiment was still at one of the top 10 levels in the survey’s 20-year history.

With promising seasonal conditions heading into autumn and strong demand continuing to underpin livestock prices, Australian farmers have also revised up their income expectations for 2021 and this is driving a major investment injection into farm business productivity over the year ahead.

Meanwhile, so positive are business conditions in Australian agriculture right now that the Rural Confidence Survey’s farm viability index – measuring farmers’ assessments of their own business viability – continues to climb, eclipsing the highest level set last quarter to sit at a new record.

The survey, completed last month, found 39 per cent of farmers nationally still expect conditions in the agricultural economy to improve in the coming year (from 43 per cent in the previous quarter), while 51 per cent expect them to remain stable.

Only seven per cent of farmers in the latest survey had a pessimistic outlook on the year ahead (down fractionally on eight per cent last quarter).

The survey showed prevailing optimism across all agricultural sectors, with sentiment particularly positive among grain and cotton producers.

Rising commodity prices and strong demand were the primary drivers of confidence in this quarter’s survey – cited by 68 per cent of those farmers forecasting conditions to improve (compared with 54 per cent last quarter).

The continuing run of good seasonal conditions, helped along by consistent summer rain and mild temperatures in many regions, is also helping keep confidence high – with the season cited by 62 per cent of farmers expecting conditions to improve this year.

For those farmers who were expecting a deterioration in the agricultural economy in the year ahead, dry conditions were the primary worry – with the strongest concerns expressed by farmers in Western Australia and Queensland.

While a turnaround in seasonal conditions had dramatically boosted Australian farmer confidence last year, uncertainty caused by COVID-19 had taken the edge off sentiment, especially in the middle of 2020. This quarter, however, just 10 per cent of farmers expecting a deterioration in conditions cited COVID as a reason for their concerns.

Rabobank Australia CEO Peter Knoblanche said 2020 had delivered a major turnaround in fortunes for many Australian farmers and the prospect of another good year was underpinning solid, long-term confidence in the sector.

“The recovery from drought and the return to production over the past 12 months has been extraordinary, despite the uncertainties around COVID-19,” he said.

“Australian grain growers delivered a record wheat harvest and near-record total winter grain harvest last season and there are promising early signs as farmers start making plans to plant this year’s crop.

“Livestock prices are breaking all sorts of records because the demand for sheep and cattle is so strong and there just aren’t the numbers to meet that demand. That is proving a challenge to those farmers trying to rebuild herd and flock numbers after the drought but providing good returns for farmers who held onto stock through the dry years.

“This year it seems all the fundamentals are lining up. We’ve had near-perfect seasonal conditions over summer for much of the country and commodity prices are very solid. Combined with low interest-rates and a number of government incentives, farmers are generally speaking in a good place right now.”

Mr Knoblanche said, however, there were parts of Western Australia and Queensland where summer conditions had been tough. But, despite the lack of rain, there was still optimism in those regions, primarily due to the underlying confidence in agriculture more broadly and solid commodity prices.

He said one of the most exciting developments unfolding in the sector was the record levels of investment, with farmers capitalising on high returns, excellent seasons and favourable business conditions to build greater productivity and profitability into their enterprises.

Mr Knoblanche said Australian agriculture had been spared much of the devastation from COVID-19 felt throughout the global economy, however workforce constraints, especially in the wool and horticulture sectors, were still a concern for some farmers this year, while market volatility, particularly in export markets dependent on China, was also behind nervousness in some sectors.

States

New South Wales rural sentiment remains the highest of any state, driven by solid confidence in seasonal conditions and the production opportunities this presents. While slightly lower than last quarter’s reading, the survey found 52 per cent of farmers surveyed in NSW expect improved business conditions over the coming year and a further 40 per cent expect conditions to remain stable.

In Victoria, strong commodity prices were also underpinning a positive outlook, with more than half the state’s farmers expecting the very good conditions enjoyed at the end of last year to continue. This quarter almost one third of Victorian farmers surveyed expected their incomes to increase. This, in turn, was fuelling strong investment plans, especially among dairy farmers, and all sectors keen to modernise water infrastructure.

In Tasmania, strong confidence was also driving investment in the sector. More than one quarter of the state’s farmers expected conditions to improve even further in coming months, while more than two thirds anticipated similar conditions to last year. This saw Tasmanian farmers reporting the strongest appetite for on-farm investment in the country.

For South Australia, sentiment was shown to be at still historically-strong levels, albeit down slightly on last quarter’s results. Despite ‘patchy’ spring and summer seasonal conditions, last year’s SA grain harvest delivered an above-average crop.

Rural confidence in Western Australia climbed to a five-year high as the state’s farmers defied challenging seasonal conditions and looked to capitalise on the ongoing strength in commodity markets. Despite limited rainfall, WA managed to harvest a large crop.

And for Queensland, although seasonal conditions have not been as positive as for other states, farmers were still displaying strong levels of confidence, evidenced particularly in near-record levels of on-farm investment expected this year.

Sectors

The latest survey found grain growers to be the most positive of all farmers this quarter, with 49 per cent expecting better business conditions than last year, and three quarters of those crediting good seasonal conditions as a key reason for their optimism.

Mr Knoblanche said the prospect of another solid production year was fuelling strong investment intentions among grain growers. Of those grain farmers planning to increase investment this year, 65 per cent identified new plant and equipment as a priority, while property purchases were of interest to 45 per cent.

Cotton sector sentiment remained strong this quarter, overwhelmingly due to improved seasonal conditions – 43 per cent of cotton growers surveyed believed business conditions would improve this year, while 56 per cent expected similar conditions to last year.

Historically-low slaughter numbers and high re-stocker demand have pushed livestock commodity prices to soaring levels, driving confidence among beef and sheep producers – 40 per cent of mixed-beef and sheep producers expect conditions to improve over the year ahead (up from 50 per cent last quarter).

Sheep producer confidence was found to be stable, with 38 per cent of sheep graziers reporting an optimistic outlook on the coming year (compared with 40 per cent last survey), with a recovery in wool prices – coupled with ideal summer conditions – underpinning confidence in the sheep sector.

Farm business performance and investment

Forecasts for farm business incomes and performance are still very high, the survey found, with 41 per cent of farmers expecting an increase in gross-farm incomes over the year ahead, while 46 per cent forecast similar returns to last year.

Mr Knoblanche said higher cash returns in many sectors had helped revive drought-affected businesses and many farmers were now looking at investments which would build drought resilience by helping to increase production and profitability and prepare for future dry periods.

The survey found expectations of improved incomes this year were highest among NSW producers, with 52 per cent of those surveyed expecting to generate greater returns. By sector, cotton farmers were shown to be the most optimistic about income projections for the year ahead.

Mr Knoblanche said one of the greatest indicators of confidence was the level of on-farm investment being planned for the year ahead, with higher income expectations and positive outlooks for autumn rainfall underpinning a strong investment appetite this survey – and up on the previous quarter.

The latest survey found 36 per cent of Australian farmers were planning to increase investment in their farm businesses, with only five per cent indicating an intention to reduce investment.

Of those planning to invest more, 65 per cent intended to spend on on-farm infrastructure (such as sheds, fences and silos), while 46 per cent identified new machinery and equipment, and more than one quarter (26 per cent) wanted to expand through property purchase.

“Increasing productivity is vital to ensuring business strength and boosting profits during good years and we are seeing a big focus on this in the investment plans of Australia’s farmers,” Mr Knoblanche said.

“New dairy barns, new wool sheds and modernising water infrastructure remain popular business investments for our farmers at the moment as they look to create efficiencies within their operations. Farmers are making the most of the good seasonal conditions, commodity price strength and favourable business incentives to help strengthen and grow their businesses. It’s an exciting period for many farmers who are very much looking forward to the year ahead.”

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the survey has been conducted by an independent research organisation interviewing farmers throughout the country each quarter since 2000. The next results are scheduled for release in June.

Rabobank Australia & New Zealand Group is a part of the global Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 93 branches throughout Australia and New Zealand.

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Skye Ward

Media Relations Manager

Rabobank Australia & New Zealand

Phone: 0418 216 103

Email: skye.ward@rabobank.com