Results at a glance:

- Australian farm sector defies COVID-19 uncertainty, with high commodity prices and excellent winter rainfall behind increasing rural confidence levels

- Sentiment soars in Western Australia, closely followed by New South Wales, where cropping prospects are strong

- Business investment levels rise as farmers seek to capitalise on high returns to grow farm productivity

A second consecutive year of good seasonal conditions and high commodity prices is helping shield Australia’s farm sector from the broader economic uncertainty of COVID-19, with farmer sentiment surging in recent months, according to the latest quarterly Rabobank Rural Confidence Survey.

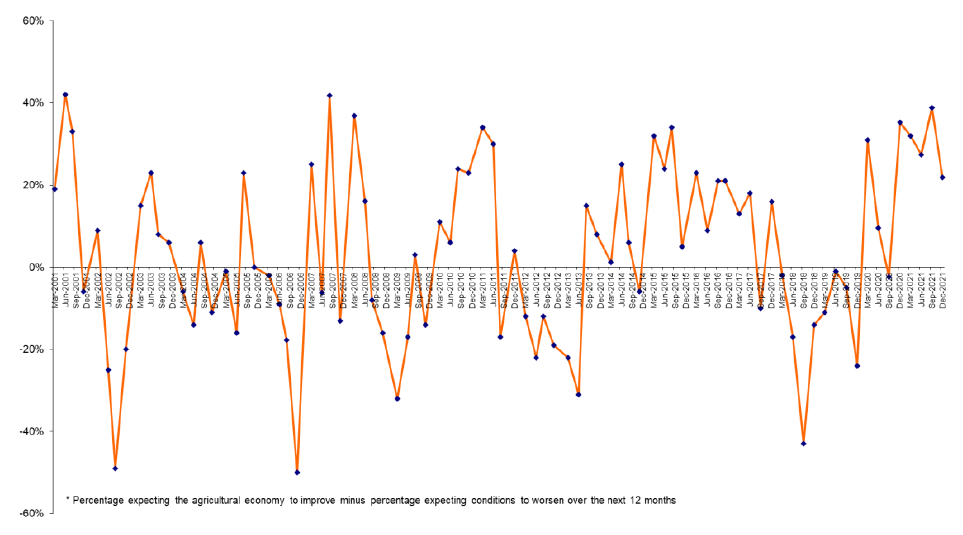

The survey, released today, reveals Australian farm sector confidence is at one of its highest levels in the survey’s history due to ongoing positive seasonal conditions and exceptionally-high commodity prices, with more than 90 per cent of Australian farmers expecting the current conditions to continue or improve further over the coming 12 months.

Rabobank Australia CEO Peter Knoblanche said conditions in Australian agriculture overall were “near perfect” with strong demand across commodities, and prices in a number of sectors at or near record highs, alongside excellent seasonal conditions, low interest rates and a lower Australian dollar.

“While there are some challenges for the farm sector due to shipping delays and labour shortages, the Australian farm sector has largely been sheltered from the broader impacts of COVID-19 restrictions and is a shining star in the Australian economy right now,” Mr Knoblanche said.

“Above-average rainfall in the late half of winter across many agricultural regions has set up the sector for another big spring, with prospects of a second year of high-yielding crops and excellent conditions for livestock.”

The latest survey, completed last month, found 43 per cent of farmers surveyed nationally expect conditions in the agricultural economy to improve over the year ahead, a jump from 35 per cent with that view last quarter.

A further 50 per cent of respondents said they expect current farm business conditions to stay the same for the coming 12 months, while just four per cent of those surveyed expect conditions to weaken.

Sentiment this quarter is equal to confidence levels in November last year, which was the third highest in the history of the 20-year survey, and close behind the highest reading ever, which was taken in February last year following drought-breaking rain.

Once again, most farmers pointed to commodity prices as the reason they believe conditions are likely to improve over the year ahead (79 per cent) while favourable seasonal conditions were also a major factor, cited by 70 per cent.

Mr Knoblanche said Rabobank’s Rural Commodity Price Index (comprising local prices for 10 agricultural commodities) was now at its highest level in the index’s 12-year history.

“Optimism is also being underpinned right now by the fact that the main factors driving commodity pricing higher are forecast to hold until at least the end of the year,” he said.

The survey also found the health of Australian farm businesses was now exceptional, with the latest Rural Confidence Survey recording historically-high levels of reported business viability, income expectations and investment intentions among farmers.

Mr Knoblanche said while not registering as major issues in this quarter’s survey, the biggest concerns among farmers in relation to COVID-19 was the impact of restrictions on securing farm labour and on shipping delays and container costs. The survey found only low levels of concern about effects of the pandemic on overseas markets, however commodity pricing and seasonal conditions were alleviating any impacts on sentiment.

Positive sentiment was strongest among Western Australian farmers, although solid across all states, while grain and cotton producers were the most confident, by sector, thanks to the combination of prices and seasonal conditions.

Significant season

Mr Knoblanche said the continuation of such favourable business and seasonal conditions would have major benefits for the longer-term viability of the Australian farm sector.

“The farm sector is enjoying tremendous times right now – we have good seasons and good returns and demand for our produce is incredibly strong,” he said.

“This is a really formative period for family-farming enterprises, because consecutive years of good returns encourage young family members to return to the land, and it enables good succession planning to take place, which is often not possible during drought years.”

Mr Knoblanche said while COVID-19 was challenging the Australian economy right now, Australian farming, as a whole, was proving resilient.

“The success we are seeing right now in agriculture is very important for the whole Australian economy as it grapples with the COVID-19 pandemic,” he said. “Agriculture is sustaining employment and economic activity in regional areas which is essential at all times, but particularly during the pandemic."

Mr Knoblanche noted though that the higher “cost of farming” was also a factor for the sector, with rising input prices and agricultural land prices at record highs.

States

Rural confidence was strongest in Western Australia, spurred to a 10-year high on the back of optimistic prospects for this year’s upcoming grain crop, albeit with earlier-season expectations of a record 20 million tonne crop now tempered by recent frost damage.

More than half the state’s surveyed farmers (52 per cent) expect rural business conditions will improve over the coming 12 months, eclipsing levels reported across the rest of the nation. While sentiment was strong across all sectors, it was the grain industry powering this quarter’s upswing in confidence, with more than three-quarters tipping improved conditions over the year ahead.

Despite major cities in lockdown at the time of the survey, New South Wales farm sector sentiment has defied broader economic uncertainty stemming from COVID-19 restrictions. NSW confidence posted a rise this quarter with 48 per cent of farmers optimistic about improved conditions over the year ahead thanks to soaking winter rains, which have set up a second consecutive favourable spring season for farmers. Overall close to 90 per cent of the state’s farmers expect the current, excellent, conditions to either continue or improve.

Sentiment in Queensland and South Australia also surged, with 43 per cent and 42 per cent respectively tipping conditions to improve over the year ahead.

Queensland rural confidence hit an 18-month high on the back of strong commodity prices, with the rise in sugar prices driving much of the upswing in sentiment.

Following a dry run into winter, positivity has soared this quarter in South Australia, hitting a 10-year high thanks to late-winter rain, which has bolstered crop prospects and expectations of above-average yields.

In Tasmania, 100 per cent of farmers surveyed (for the second consecutive quarter) expect currently-excellent business conditions to either continue or improve further over the next 12 months, with dairy farmer confidence particularly strong. While COVID-19 restrictions are having some impact on the horticulture and aquaculture sectors, the farm sector overall has been largely sheltered from any broader fallout.

Commodity pricing, along with a wet winter, prompted a significant lift in Victorian sentiment this quarter – with more than one-third of the state’s farmers expecting conditions to improve over the next year, and very few forecasting conditions to deteriorate.

Sectors

Continued rainfall throughout the winter months has helped maintain above-average soil moisture levels to sustain crop and pasture growth as livestock and cropping farmers enter the crucial spring growing period.

According to the survey, cotton sector confidence was again very strong this quarter, with 70 per cent of cotton growers surveyed expecting conditions to improve over the year ahead.

The new cotton season is now underway with planting commenced in Queensland, and forecasts are for a second consecutive large increase in planted area across the country. Favourable soil moisture and good water availability in almost all cotton regions and strong prices are driving producer confidence. Forward prices are also strong, with Cotton Australia estimating more than 30 per cent of next year’s cotton crop has already been sold from grower to merchant.

Grain sector confidence has risen this quarter as farmers prepare to harvest what is shaping up to be another big crop in coming months. The survey found 64 per cent of grain growers expect conditions to improve over the year ahead, up from 34 per cent last quarter, while 35 per cent expect a year like last year.

Mr Knoblanche said while nearly all regions had enjoyed good autumn and winter conditions, and growers were again hopeful of above-average yields this year, they were also anxious for some sunshine and warm days to get crops through the final growing phases.

He said unfortunately there were already reports of mice re-appearing in some of the north-west regions of NSW and aerial baiting was underway to try to contain the outbreak and minimise crop damage, but again this had not weighed significantly on this quarter’s survey results.

Significant international supply constraints have seen sugar prices hit four-year highs, boosting confidence in the Queensland sugar sector – with 61 per cent of producers surveyed forecasting better business conditions over the year ahead.

Records continue to be broken in beef and sheepmeat markets, with local re-stocker demand on top of the ongoing, worldwide demand for protein, repeatedly pushing livestock commodity prices to new highs and supporting strong sector confidence.

The survey found 54 per cent of beef producers expect the current, excellent conditions to continue over the year ahead, while 39 per cent tip conditions will improve further.

Similar sentiment was recorded among sheep producers – 58 per cent expect similar conditions over the coming 12 months, while 34 per cent expect an improvement.

Mr Knoblanche said wool producer confidence was holding despite ongoing market uncertainty stemming from COVID-19, with prices improving following falls last year.

Dairy sector confidence was also solid this quarter, with 56 per cent of surveyed producers optimistic current conditions will continue, while 36 per cent expect conditions to improve.

Farm business performance and investment

This quarter, Australian farmers revised up forecasts for the financial performance of their businesses, with 51 per cent expecting incomes to increase this year (up from 40 per cent last quarter), while 37 per cent expect a stable income.

Mr Knoblanche said farmers were continuing to make the most of the current conditions by reinvesting in their businesses to make them more productive and efficient.

“With land prices continuing to skyrocket, many farmers are focusing on investments that maximise their returns through productivity if expansion is too expensive or land too hard to procure.”

Mr Knoblanche said drought was also still fresh in the minds of many producers, and farmers were focusing on investments in infrastructure to assist drought preparedness to help better-manage climate variability in the future.

The survey found 37 per cent of farmers nationally intend to increase business investment in the next year (up marginally from 34 per cent last quarter) while 56 per cent will maintain current investment spending.

According to the results, of those intending to increase investment, three quarters plan to spend on-farm infrastructure such as silos, fencing and new yards. More than half intend to purchase new machinery or equipment, while increasing livestock numbers was a priority for 49 per cent of those planning to invest more on farm.

Mr Knoblanche said the investments farmers were making in their own businesses now would have a positive impact for many years to come.

“These are great times for Australian agriculture. This is a defining period for our industry, and one which will pave the way for our sector for many years to come.”

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the survey has been conducted by an independent research organisation interviewing farmers throughout the country each quarter since 2000. The next results are scheduled for release in December 2021.

Rabobank Australia & New Zealand is a part of the global Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 93 branches throughout Australia and New Zealand.

To arrange an interview or for more information on Rabobank’s Rural Confidence Survey, please contact:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Skye Ward

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: skye.ward@rabobank.com