After three consecutive strong harvests, Australian grain and oilseed production is set to return to more modest totals for the current season as drier growing conditions ‘hit home’, Rabobank says in its just-released 2023/24 Australian Winter Crop Forecast.

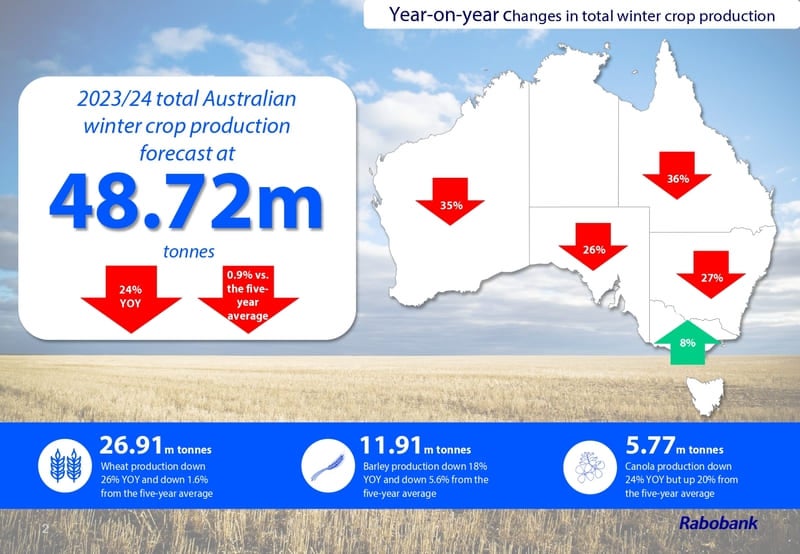

The bank says Australia is on track to harvest a total winter crop of 48.72 million tonnes for the current season. While down 24 per cent on last season’s record-breaking 63.85 million tonne national crop, this is still close to the five-year average and above totals recorded in 2018/19 and 2020/21.

And prices are expected to provide some silver lining to the lower production totals for Australian farmers, says report co-author, RaboResearch associate analyst Edward McGeoch, with dry conditions in Australia pushing local prices above those globally, to a ‘positive basis’ for wheat and also barley. While global export demand should also be supportive of canola prices.

Mr McGeoch says drier weather conditions that have spread across many cropping regions in the country and the prevailing El Nino climate outlook are playing a significant role in the tighter supply outlook for Australian grain and oilseeds.

“Production expectations are varied across regions with some farmers expecting to see elevated production due to positive growing conditions they have experienced while others will be facing tough decisions as to whether it will be worth harvesting their crop,” he said.

The bank says all cereal and coarse grain production – including wheat, barley and oats – is expected to decrease this season, with wheat declining the furthest, down to 26.9 million tonnes.

Winter crop production is expected to decline across all states, except Victoria, where the bank sees it rising by eight per cent from last year.

However, Mr McGeoch says, this is primarily due to the losses incurred during last year’s harvest, with a significant proportion of crops in the northern parts of the state unable to be harvested because of flood damage.

“Parts of Victoria have seen further strong rainfall across cropping regions in early October which will play a significant role in determining if these targets will be achieved or exceeded,” he said.

Commodities

While Australia’s wheat production is forecast to come in at 26.9 million tonnes (down 26 per cent on last season), barley and canola will suffer less decline, Rabobank says.

“Barley is expected to see the slightest decline in all grains and oilseeds this year (down 18 per cent on last year to 11.91 million tonnes),” Mr McGeoch said. “However, this is primarily due to an increased planted area for barley this season compared with 2022/23, while the remainder of the winter crop varieties saw reductions in planted area.”

Canola production is forecast to fall 24 per cent on last year to 5.77 million tonnes. This total, however, remains 20 per cent higher than the five-year average, Mr McGeoch said, while pulse production – though forecast to be down this season – also remains slightly higher than the five-year average, at 3.08 million tonnes.

States

The biggest declines in total grain and oilseed production are expected in Queensland and Western Australia, at 36 per cent and 35 per cent respectively on last season.

For Queensland, 2023/24 total production is forecast to come in at 2.15 million tonnes, taking a significant hit due to dry weather conditions.

“Wheat is expected to see the largest fall in the state, down 41 per cent year on year, which is compounded by a reduction in planted area this season, however it does remain above the five-year average,” Mr McGeoch said.

Expectations are for production totals in WA to fall to 14.27 million tonnes.

This total has been influenced by several factors, Rabobank said, including the late ‘autumn break’ leading to crops being planted in cooler conditions, which increased frost susceptibility.

“This has been coupled with lack of rainfall during the growing season leading to poorer soil moisture levels once high temperatures returned in early spring,” Mr McGeoch said.

Total tonnage for NSW winter crop is forecast to decline 27 per cent on last year (to

11.03 million tonnes). The state’s central and north west regions have been worst hit by dry spring conditions and lack of rainfall totals during the growing season, with only 70 per cent of total planted crop area expected to be harvested in some parts.

For South Australia, production totals are expected to fall to 9.3 million tonnes. While this is down 26 per cent from the extremely strong 2022 season, Mr McGeoch said, these volumes remain well above the five-year average.

Exports

The report says Australia’s export outlook for the year ahead will be significantly impacted by the fall in the production potential for the current season, “given we are coming off a string of consistently strong seasons”.

“We are however still well positioned to support global wheat needs, while also seeing supportive factors for canola and barley exports,” Mr McGeoch said.

Given the reduced production outlook, Australia’s exportable surplus from the current 2023/24 wheat crop (excluding 2022/23 carryover) is forecast to total 18.6 million tonnes, with global export demand remaining strong despite Russia increasing its share of the wheat export market.

Barley and canola export surpluses from the 2023/24 harvest (excluding carryover from last season) are expected to total 5.9 million tonnes and 4.6 million tonnes respectively. “Again, reductions in global production of barley and canola are supporting export demand to key markets,” Mr McGeoch said.

Commodity price outlook

Moving to the end of this year, the bank says, the environment is becoming more supportive for global grain prices, with all major grain harvests, bar Australia, to be wrapped up by December. Dry conditions in Canada and Argentina are also putting potential additional pressure on global supply.

Rabobank forecasts CBOT (Chicago Board of Trade) wheat, the bellwether for global wheat prices, to trade around USc 575-655/bu over the next 12 months, seven per cent below the five-year average. CBOT corn prices, indicative of global feed grain prices, are expected to trade between USc 470-525/bu, 35 per cent below the five-year average.

Locally, the bank expects national track/Free in Store (FIS) APW1 wheat prices to trade, on average, between AUD 360-400/tonne over the next 12 months.

Feed barley track/FIS prices are expected to trade, on average, between AUS 320- 370/tonne over the next 12 months, just above the five-year average of AUD 312/tonne.

“The reduced supply outlook is supporting local prices, as we have domestic consumption and export competition,” Mr McGeoch said.

For canola, the bank believes there will be support for higher global prices due to smaller Canadian and Australian crops compared with last year, while Canada is also expected to crush more internally in early 2024.

Locally non-GM canola prices are forecast to trade, on average, between AUD 650- 700/tonne over the next 12 months.

Farm inputs

Australian farmers are expected to face a better year ahead when it comes to their farm input costs, the report says, with the exception of diesel.

Report co-author, RaboResearch agricultural analyst Vitor Pistoia says there are two “driving forces” behind the improved outlook for input costs.

“These are lower global prices for many inputs due to a new balance of supply and demand, which is favouring supply,” he said.

“Also input prices in Australia tend to lag behind the rest of the world, with a long lead time before changes in global input prices are felt locally. This means that the prices farmers will have here when they procure their inputs by early 2024 will be the ones that are seen globally in quarter three and four of this year, which are tracking at much lower levels than the same period in 2022.”

The reports says, based on market factors at the moment, urea is expected to remain near current levels and phosphate to ease by 10 to 15 per cent in early 2024. For potash, the forecast is for stable prices.

Agro chemicals are likely to have lower prices and better affordability in the 2024 season, Mr Pistoia said.

Diesel prices, however, look to remain at elevated levels, due to capped petroleum production in many exporting nations, along with reduced global refinery capacity, impacted by shutdowns and maintenance. Brent oil prices should stay around the USD 95/barrel mark, with potential hikes up to USD 100/barrel possible.

“These factors, combined with expectations for a continuing weak Australian dollar, put the diesel terminal gate price slightly above AUD 2/litre, in a range between AUD 2 to 2.2/per litre,” Mr Pistoia said. “This is six to 17 per cent above January 2023 prices.”

For machinery and parts, despite substantial reductions in component costs in the past 12 months – including for steel, rubber and international freight – prices are not expected to decline considerably. This is due to the weaker Australian dollar and local inflation in machinery-producing nations.

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 90 branches throughout Australia and New Zealand.

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com