16/06/2025

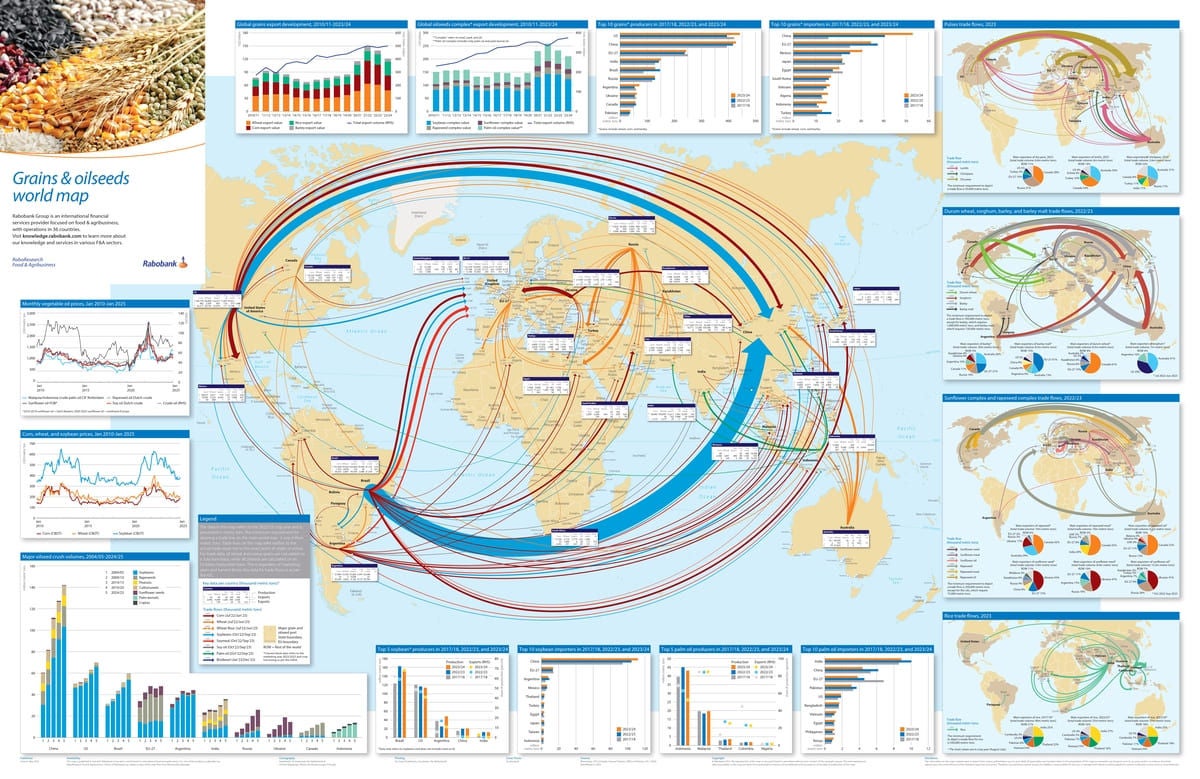

The global grains and oilseeds trade continues to grow steadily and reached around 880 million metric tons in 2023/24, with an estimated value of USD 330 billion, according to Rabobank’s just-published global grains and oilseeds world map.

The sixth edition of the map and accompanying report – charting recent global production, consumption and trade – found despite the sharp price spike caused by the war in Ukraine, trade volumes have increased over the past five years, by a compound annual growth rate (CAGR) of 3.2 per cent for grains and 2.4 per cent for oilseeds from 2018 to 2023. Albeit, the report says, at a slower pace compared to the seven per cent CAGR seen in the previous decade.

Wheat trade

Wheat was the most traded grain globally, with an average of 216 million metric tons traded annually between 2021 and 2023.

“Overall, the wheat market is highly fragmented when it comes to production, imports and exports, and the number of players,” RaboResearch Netherland-based senior grains and oilseeds analyst Vito Martielli said.

Click on the image above to download a PDF of the World Map

Russia emerged as the world’s leading wheat exporter, significantly outpacing its competitors.

Since the publication of Rabobank’s first Grains and Oilseeds World Map in 2003, wheat imports by the top 10 importers have grown at a 3.5 per cent CAGR (2001/02 to 2022/23). In these markets, Russian exports grew at a 10 per cent CAGR, compared to five per cent each for Ukraine, the EU and Australia.

Notably, the report said Australia has strengthened its position in Asian markets.

Meanwhile, the US has lost market share, with exports declining by a one per cent CAGR over the same period.

Among the top importers, Egypt remains the largest wheat importer in Africa, Turkey is increasingly serving as a hub for wheat imports and re-exports and China has increased its imports due to a rise in domestic consumption over the past five years.

Corn production

Corn was the second most-traded grain globally, with an average of 193 million metric tons traded annually between 2021 and 2023. Unlike wheat, corn production and exports are highly concentrated in four countries – the US, Brazil, Argentina and Ukraine – which together account for 90 per cent of global corn trade.

Soybean consumption

Soybeans were the most-traded oilseeds globally and they are not widely produced in the countries which are the biggest buyers. An average of 168 million metric tons were traded annually between 2021 and 2023.

Production is concentrated in Brazil, the US and a few other countries in South America, while Asia and EU are the biggest importers globally. “Developed countries such as those in the EU and Japan – which were the largest importers in 2002 – are now experiencing negative import growth, driven by dietary changes and a decline in animal protein consumption,” Mr Martielli said. “China has emerged as the key driving force in the global soybean trade and crushing industry, reporting exponential growth in both consumption and imports. Brazil has become the largest producer and exporter globally.”

Future trade flows

In the next decade, multiple factors are expected to influence global grains and oilseeds trade flows, Rabobank says.

On the demand side, the growing population in Sub-Saharan Africa is expected to drive increased wheat imports, while China may experience a slowdown – or even a decline – in soybean imports, according to the report. Changes in biofuel policies are likely to affect oilseed crushing dynamics, and the implementation of the EU Deforestation Regulation (EUDR) is already reshaping traders’ business models, it says.

Additionally, the Rabobank report said, weather can have a significant impact on crop yields and price volatility while a distribution of power to multiple players will reshape trade relationships and strategic priorities across the value chain.

RaboResearch Disclaimer: Please refer to Australian RaboResearch disclaimer here

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 125 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of more than nine million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 87 branches throughout Australia and New Zealand.

Media Contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com